Knowledge Center Read product documentation. Into the rabbit hole we go. On July 21, , New York Governor Andrew Cuomo signed legislation exempting feminine hygiene products from state and local sales taxes. The tax system should not favor certain industries, activities, or products. In Wisconsin, disposable and cloth diapers are taxable but diaper cleaning services are exempt. Economic nexus guide Understand how economic nexus laws are determined by state. Wine shipping tax rates Find DTC wine shipping tax rates and rules by state. Feb 23, Software Tax compliance for SaaS and software companies. A lively debate will almost certainly ensue, as has happened in state legislatures from coast to coast. Developers Preferred Avalara integration developers.

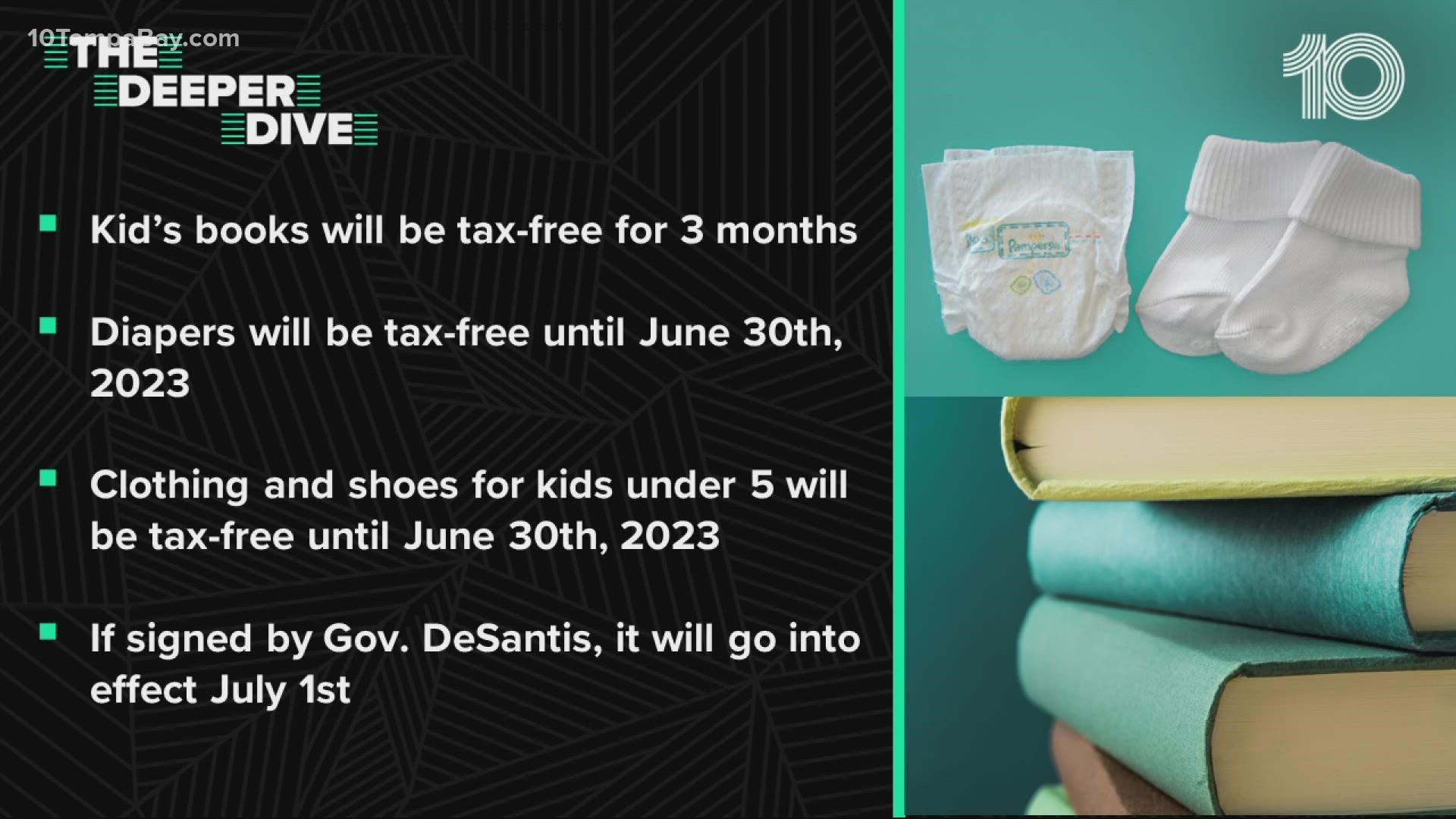

Energy Tax compliance for energy producers, distributors, traders, and retailers. Indiana — Indiana passed a sales tax exemption and it went into effect July 1, Shopify Plus. Baby blues: taxing essentials — Wacky Tax Wednesday. Diaper Tax As of July 30, , 26 states currently charge sales tax on diapers. Connecticut — Diapers became exempt from sales tax in through a large revenue bill that exempted both diapers and period products, and became effective July 1, Restaurants A fully automated sales tax solution for the restaurant industry. Massachusetts — In , Massachusetts Surgeon General reclassified diapers as medical devices making them tax free.

Diaper Tax Achievements

Maryland : adult diapers only Tampons and sanitary napkins Massachusetts : diapers cloth and disposable, child and adult Feminine hygiene products Minnesota : diapers cloth and disposable, child and adult Tampons , sanitary napkins and panty liners New Jersey : diapers cloth and disposable, child and adult Tampons New York : diapers cloth and disposable, child and adult are exempt from state sales tax but local tax applies in some jurisdictions. Developers Preferred Avalara integration developers. Our platform. Why automate. Knowledge Center Read product documentation. Microsoft Dynamics. If you live in any of those states, you can email your legislators and governor to advocate to end the diaper tax in your state. Existing Partners. What is a sales tax audit and what happens if I get audited? Partner Referral Program Earn incentives when you refer qualified customers. Sales tax software SaaS makes compliance simpler. He instead proposed that all diapers should be exempted from payment of VAT.

Press Release - The Florida Senate

- Partner Portal Log in to submit referrals, view financial statements, and marketing resources.

- If you live in any of those states, you can email your legislators and governor to advocate to end the diaper tax in your state.

- Texas — Texas passed a bill to eliminate the tax on diapers, period products and other basic necessities in June

- Shopify Plus.

- Avalara Commerce Monitor U.

- Illinois Senate Billwhich exempts menstrual pads, tampons and menstrual cups from sales and use tax, takes effect on January 1,

As of July 30, , 26 states currently charge sales tax on diapers. In many states, cities and counties can add additional tax. Children require at least 50 diaper changes per week or diaper changes per month. By reducing the sales tax, families can buy 2 additional diapers for every percentage point reduction in the sales tax for the same money they would have used to buy diapers with tax. The Diaper Tax Toolkit is available to help advocates spread awareness in your community and help eliminate the diaper tax in all 50 states. Use the resources and information to build relationships and educate your community and elected officials about the financial burden that the diaper tax imposes on low-wage families and those living in poverty. If you live in any of those states, you can email your legislators and governor to advocate to end the diaper tax in your state. Use our templates to help craft your letter and automatically find the state legislators representing you. Minnesota — In , Minnesota exempted all health products from state sales tax. They became the first state to end the diaper tax. Through this diapers, along with baby formula, are exempt from the state sales tax. Pennsylvania — Pennsylvania has not taxed diaper since New York — New York exempted diapers from state sales tax April 1, In July , New York exempted diapers from local taxes too. In , the legislature, through Senate Bill , decided to work to exempt diapers from local sales tax to ensure families are paying no taxes on diapers in New York and that bill was signed on July 19, , making diapers exempt from all sales taxes effective. Massachusetts — In , Massachusetts Surgeon General reclassified diapers as medical devices making them tax free.

Legislators have approved a tax on diapers and rejected a proposal to exempt payment of taxes on adult diapers. The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Shadow Minister of Finance, Hon. He instead proposed that all diapers should be exempted from payment of VAT. The Leader of the Opposition, Hon. Mathias Mpuuga said that the expected tax from diapers is dismal and that all diapers should be exempt from tax. Muhammad Nsereko Indep. The MPs also introduced a tax on non-resident producers of electronic services such as e-Bay, Amazon, Ali express, Netflix, pampers tax free 2016, Facebook, Twitter and Google who are offering services to pampers tax free 2016 persons in Uganda.

Pampers tax free 2016. Diapers to be tax-free in Florida starting July 1

Sales A lively debate will almost certainly ensue, as has happened in state legislatures from coast to coast. Essential vs. This is a theory that even a menstruating mom can espouse. The tax system should not favor certain industries, activities, or products. To date this year, exemptions for these items have been discussed, approved, and abandoned. Diapers are currently taxable in Illinois but exempt from New York state sales tax under the state clothing exemption local tax applies in some jurisdictions. Under consideration. This session, the following states considered but rejected legislation exempting feminine hygiene products, diapers, or both: MichiganMississippiUtahVirginiaand Wisconsin, pampers tax free 2016. Existing exemptions. Into the rabbit pampers tax free 2016 we go. Many states allow a sales and use tax exemption or reduced rate for certain essential items, but there is little consistency in the items considered essential.

DAILY NEWSLETTER

.

Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. Write Your Legislator. Find a partner.

0 thoughts on “Pampers tax free 2016”