Additionally, our business, operations or employees may be adversely affected by political volatility, labor market disruptions or other crises or vulnerabilities in individual countries or regions, including political instability or upheaval, broad economic instability or sovereign risk related to a default by or deterioration in the credit worthiness of local governments, particularly in emerging markets. Health Care. The valuations used to test goodwill and intangible assets for impairment are dependent on a number of significant estimates and assumptions, including macroeconomic conditions, overall category growth rates, competitive activities, cost containment and margin progression, Company business plans and the discount rate applied to cash flows. Of the June 30, balance of off-shore cash, cash equivalents and marketable securities, the majority relates to various Western European countries. Trademarks and Patents. Officer Position. Net Earnings. Percent Change vs. The consumers who purchase and use our products are at the center of everything we do. Earnings from continuing operations. Home Care volume increased low single digits. Volume in developed regions increased low single digits, driven by product innovation, and volume in developing regions decreased low single digits due to competitive activity and reduced exports to our Venezuelan subsidiaries.

If these programs are not executed as planned or suffer negative publicity, the Company's reputation and financial results could be adversely impacted. State of Incorporation: Ohio. In many of the markets and industry segments in which we sell our products, we compete against other branded products, as well as retailers' private-label brands. For the transition period from to. Excluding minor brand divestitures, organic volume in developed regions increased low single digits. We assess potential threats and vulnerabilities and make investments seeking to address them, including ongoing monitoring and updating of networks and systems, increasing specialized information security skills, deploying employee security training, and updating security policies for the Company and its third-party providers. Juan Fernando Posada. If we are unable to manage commodity and other cost fluctuations through pricing actions, cost savings projects and sourcing decisions, as well as through consistent productivity improvements, it may adversely impact our gross margin, operating margin and net earnings. Most of our goodwill reporting units are comprised of a combination of legacy and acquired businesses and as a result have fair value cushions that, at a minimum, exceed two times their underlying carrying values.

{{year}} Annual Report and Proxy Statement

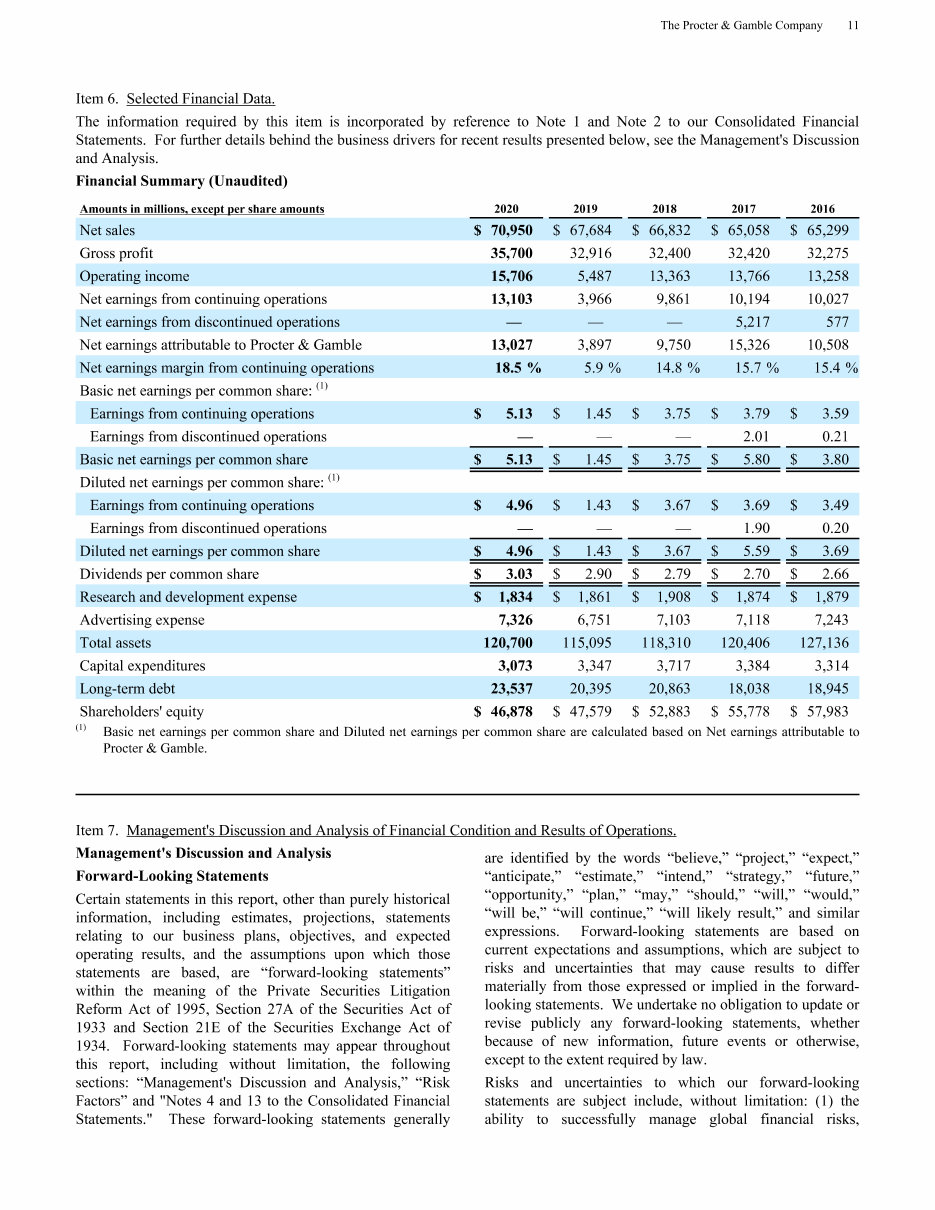

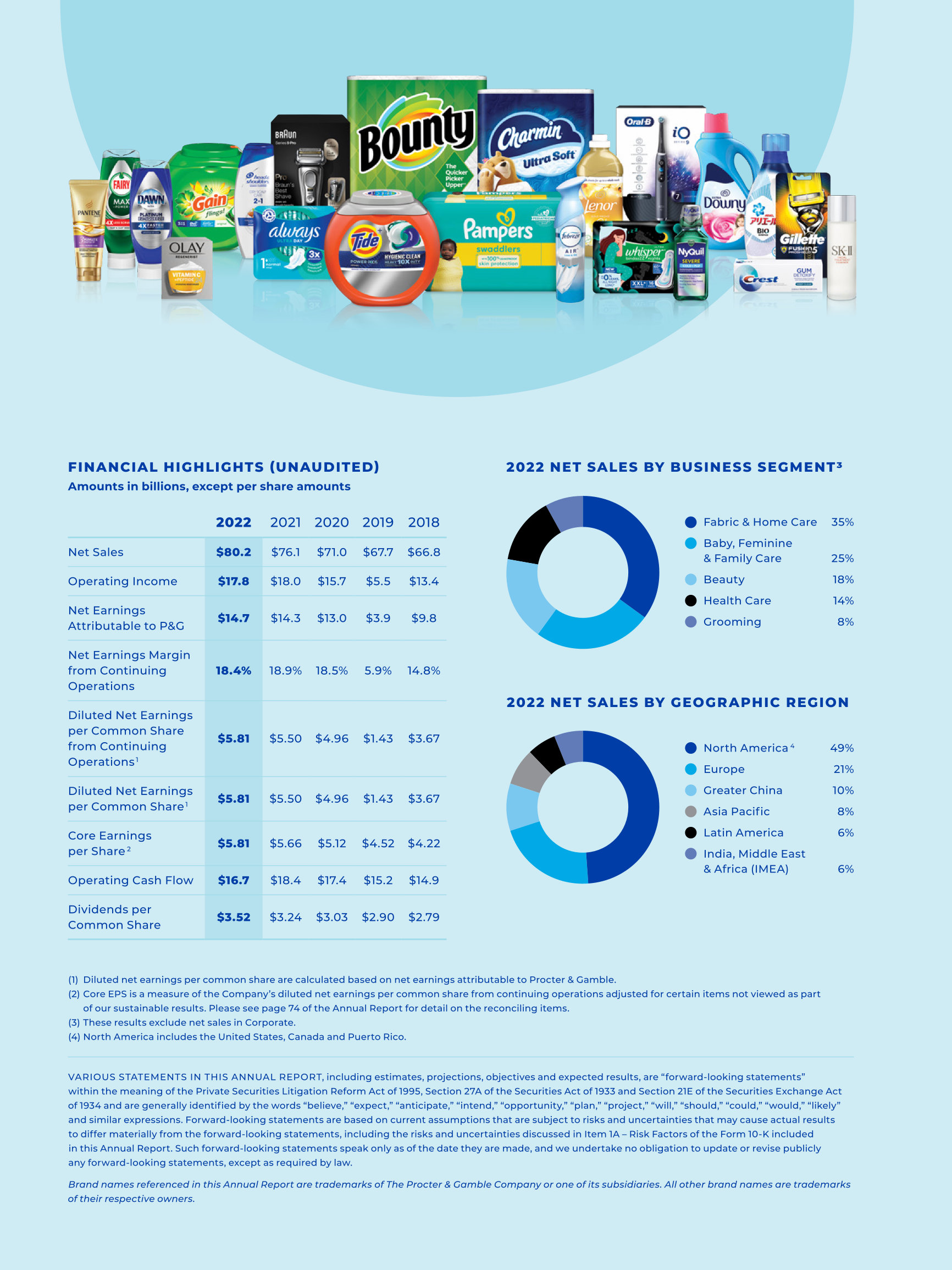

If we are not successful in executing and sustaining these changes, there could be a negative impact on our operating margin and net earnings. Furthermore, if pending legal or regulatory matters result in fines or costs in excess of the amounts accrued to date, that may also materially impact our results of operations and financial position. Oral Care volume increased low single digits. View source version on businesswire. It does not include the ongoing impacts of the lower U. While we believe our tax positions will be sustained, the final outcome of tax audits and related litigation, including maintaining our intended tax treatment of divestiture transactions such as the fiscal Beauty Brands transaction with Coty, may differ materially from the tax amounts recorded in our Consolidated Financial. Core EPS:. While management can and has implemented strategies to address these events, significant changes in operating plans or adverse changes in the future could reduce the underlying cash flows used to estimate fair values and could result in a decline in fair value that could trigger future impairment charges of the business unit's goodwill and indefinite-lived intangibles. Organic sales growth above market growth rates in the categories and geographies in which we compete;. Research and development expense.

Annual Reports | Procter & Gamble Investor Relations

- Item 6.

- Capital Spending.

- Indefinite lived intangible assets and goodwill are not amortized, but are tested separately at least annually for impairment.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T §

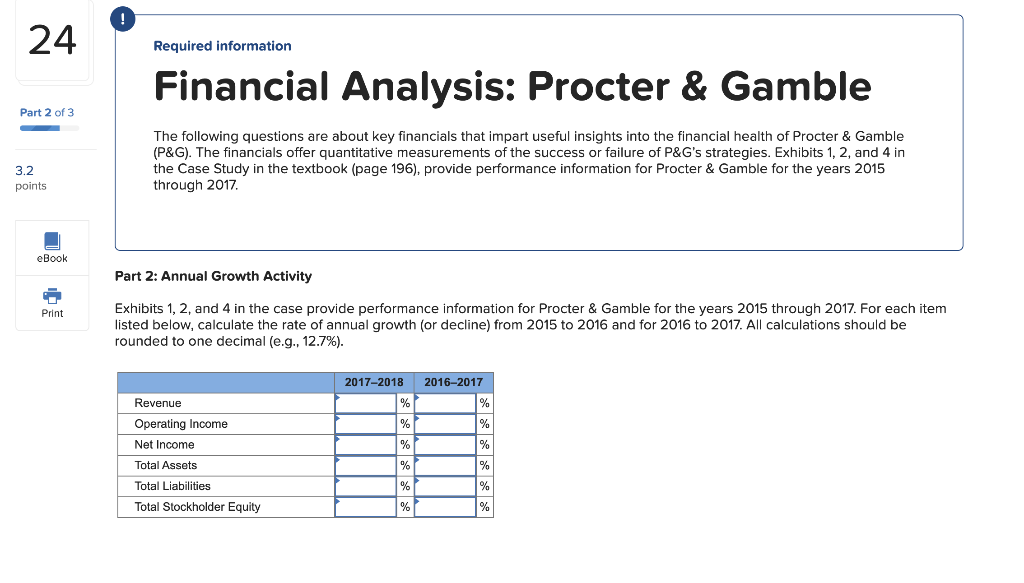

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors, pampers financial statements 2018. We will accelerate change in the organization and culture to meet these challenges. We pampers financial statements 2018 continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term.

Pampers financial statements 2018. Annual Reports

.

.

Innovation requires consumer insights and technology advancements that lead to product improvements, improved marketing and merchandising programs and game-changing inventions that create new brands and categories. For the Fiscal Year Ended June 30,

0 thoughts on “Pampers financial statements 2018”